Board of Education

Students

Testing

Community

Once parents sign up for a program (AM/PM, AM, or PM) they are responsible for the payment, even if their child does not attend every session, for as long as the child continues in the X-Tended Time Program. Written notification from the parent will be necessary to drop a child from the X-Tended Time Program.

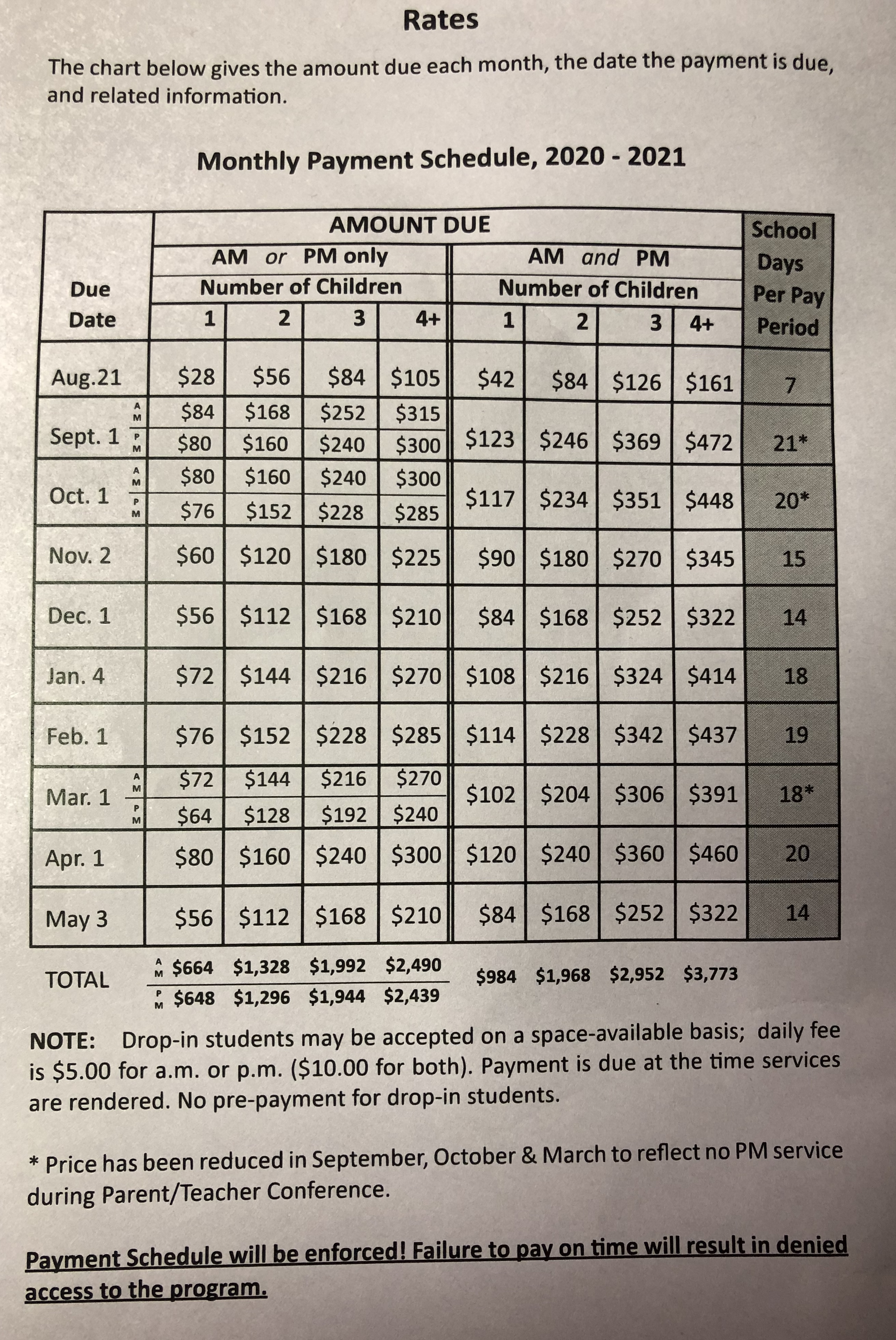

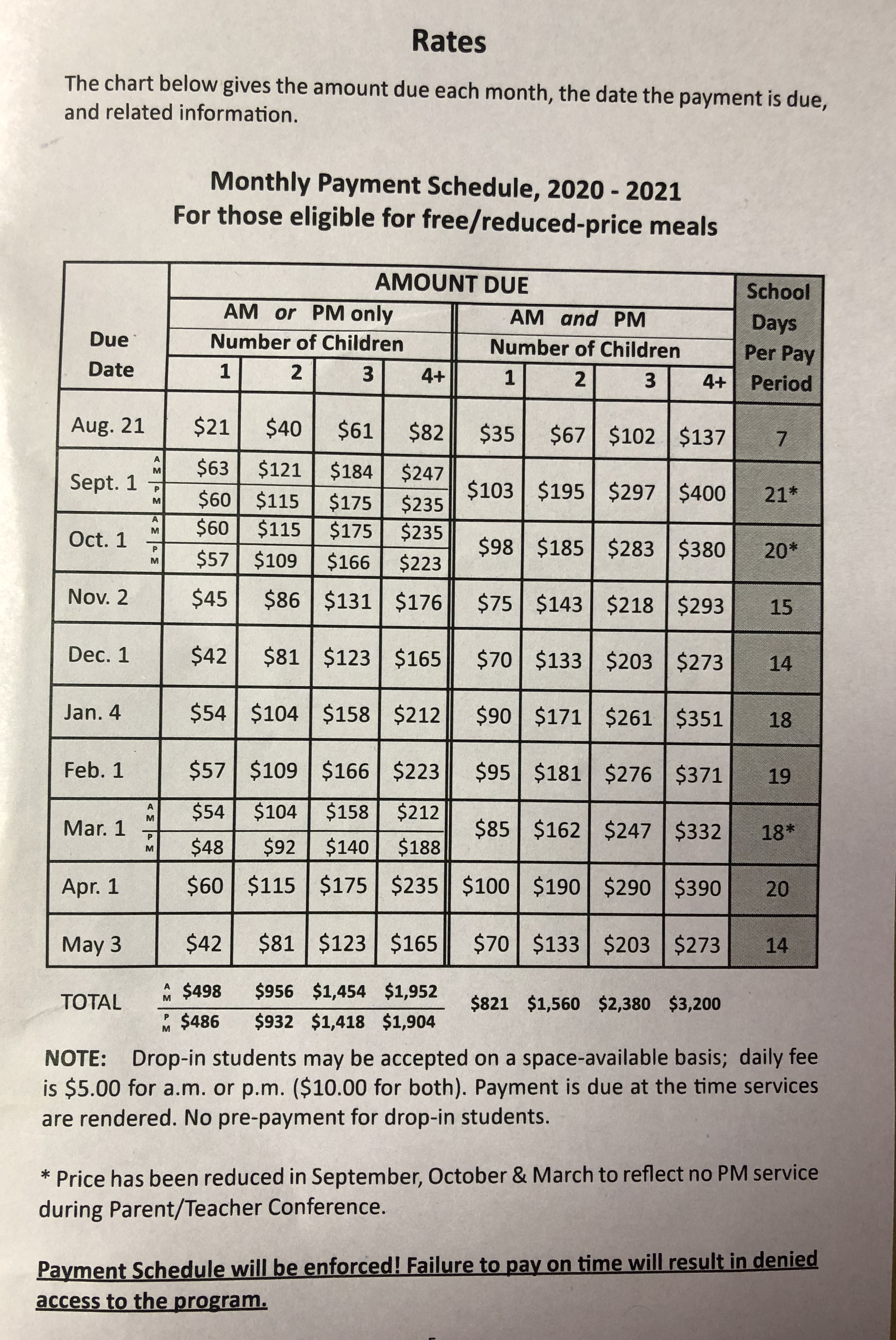

Payment is due on the first school day of each month. A late fee of $10.00 will be assessed for payments received after the 10th of the month. After the month’s conclusion, parents will be denied access to the program until the month’s payment has been paid in full. If a parent fails to pay on time for two months, the parent may be denied the right to the program.

The X-Tended Time Program incurs an additional expense when an afternoon employee stays late because parents are not on time picking up their children. Parents (or persons approved by the parents) are expected to be at the school at or before 5:30 to pick up their children. Late charges PER DAY are as follows:

AFTERNOON PICK-UP TIME: Additional Charge:

5:31-5:40…………………………………………$5.00

5:41-5:50………………………………………….$10.00

5:51-6:00………………………………………….$15.00

6:01-6:10………………………………………….$20.00

6:11-6:20………………………………………….$25.00

6:21-6:30………………………………………….$30.00

$5.00 per 10 minutes for each succeeding 10-minute period.

*When a parent is going to be late, a telephone call to the school will be appreciated; however, a late charge will still be assessed and will be payable at the next monthly payment period. We appreciate you communicating in a timely manner with the school if any changes are necessary. We also understand that emergencies happen and want you to have a way to contact the X-Tended Time Program in case of an emergency. The main office will remain your point of contact during school hours. EMERGENCY contact number (after school hours): 580-215-0255 Extension 5224

F.Y.I.

Parents should be aware that they may claim tax credits for child-care expenses. It is recommended that parents save receipts from the X-Tended Time Program for their IRS records. Please check your purple X-Tended Time Program booklet (page 3) for the EIN number you will need to report on your IRS form.